The Paralysis of Uncertainty

My hands trembled slightly as I scrolled through another disappointing quarterly report. Another missed opportunity, another set of investments that seemed to drift aimlessly through the market’s turbulent waters. As a mid-level financial analyst at a regional investment firm, I was quickly becoming known as the team member who consistently underperformed.

“Sarah, we need to talk,” my manager Jim had said just last week, his voice heavy with disappointment. “Your portfolio recommendations aren’t cutting it. The partners are asking questions.”

The pressure was suffocating. Each day felt like walking a tightrope without a safety net, knowing that one more misstep could cost me everything I’d worked so hard to build.

The Invisible Barriers

Investment had always been my passion, but somewhere along the way, the complexity of the market had transformed my enthusiasm into paralyzing anxiety. I’d tried everything – countless investment books, online courses, webinars promising insider secrets. Yet nothing seemed to click.

My colleagues made it look effortless. They’d casually discuss stock picks over coffee, their conversations filled with confidence and nuanced insights. Meanwhile, I was drowning in spreadsheets, overwhelmed by conflicting data points and endless analysis.

The fundamental problem wasn’t just about selecting stocks. It was about understanding the intricate dance of market dynamics, about developing an intuitive sense of potential and risk. And that felt impossibly out of reach.

A Whisper of Hope

I first heard about Sterling Stock Picker during a late-night professional networking forum. A fellow analyst mentioned it almost offhandedly, describing it as a game-changer for investors feeling lost in the market’s complexity.

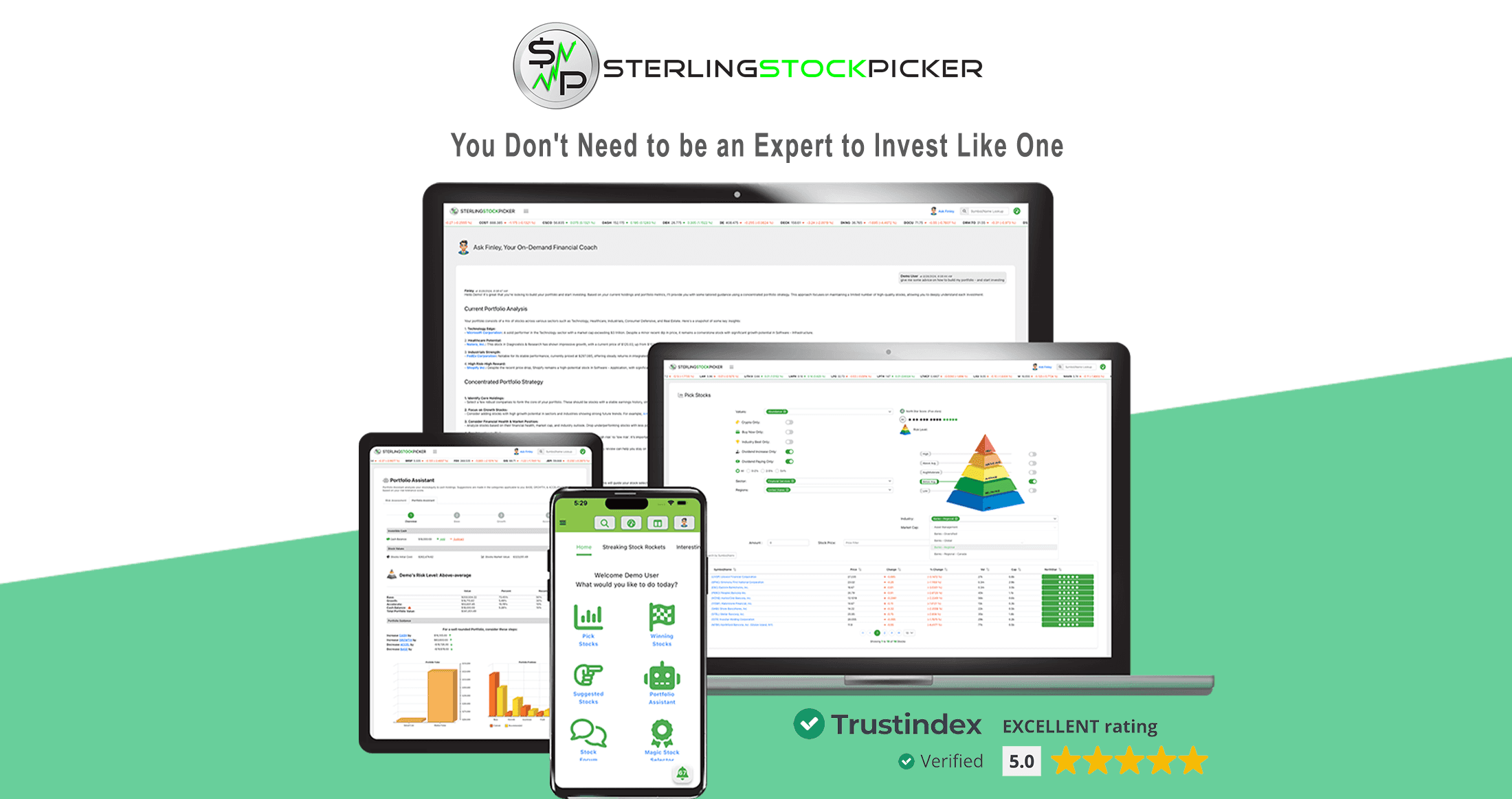

Initially skeptical, I watched demonstration videos with my usual defensive posture. Another overhyped tool promising miracles, I thought. But something was different this time. The platform’s approach felt… human. Not just a collection of cold, algorithmic recommendations, but a thoughtful guide designed to understand an investor’s unique journey.

The moment I implemented Sterling Stock Picker, everything changed. Its Northstar Guidance Rating wasn’t just another technical metric – it was a comprehensive lens that evaluated stocks through multiple strategic indicators.

“Look at this,” I remember telling my research assistant, Maria, pointing at the screen. “It’s not just recommending stocks. It’s explaining why.”

The customizable stock screener became my new strategic companion. I could filter investments based on my specific risk tolerance, sector preferences, and long-term goals. No more drowning in endless data – just clear, actionable insights.

But the real magic happened with the Portfolio Assistant. For the first time, I wasn’t just reacting to market movements – I was proactively managing my investment strategy. The weekly live streams and community forum provided context, turning abstract financial concepts into tangible learning opportunities.

A New Professional Landscape

Three months into using Sterling Stock Picker, I presented my latest portfolio recommendations to the executive team. The room was silent – not the uncomfortable silence I’d grown accustomed to, but one of genuine intrigue.

“These are some of the most thoughtful, well-researched recommendations we’ve seen,” Jim said, a hint of pride replacing his previous disappointment.

My confidence wasn’t just about better numbers. It was about understanding the story behind each investment, recognizing patterns, and making decisions rooted in strategic insight rather than fear.

Epilogue: The Investor’s Wisdom

What I learned transcends any single investment tool. True success comes from embracing technology that enhances human insight, not replacing human judgment. In a world drowning in information, the real skill is finding platforms that transform complexity into clarity.

For any professional feeling overwhelmed by their field’s technical challenges, remember: The right tool doesn’t just solve problems – it reveals your untapped potential. Stay curious, remain adaptable, and never stop learning.

💥 Bonus Alert for Buyers!

Every purchase made today through this website qualifies for a FREE SEO backlink from my business directory – straight to your website! 🎯

This isn’t just any link. It’s a powerful way to boost your rankings by getting targeted anchor text pointing to your most important pages. For example, if you’re an accountant in Los Angeles, you might want one link to say “Accountants in Los Angeles” and another like “Accountant Silver Lake Blvd, Los Angeles.”

You can earn multiple links over time by continuing to shop here – perfect for building out your SEO strategy with relevant subpages!

👉 Before you submit your bonus request, please do your keyword research. I’ll use the exact anchor text you provide, so make it count!

Need help figuring out what keywords to target? Just grab one of my Website Video Reviews, and I’ll walk you through your best SEO game plan.

Got any questions about this Sterling Stock Review Story? Drop a comment below! The more excitement we generate around this product, the better chance I have to negotiate even bigger bonuses or exclusive deals for you down the line. 💬🔥