The Spreadsheet Nightmare

My hands trembled as I stared at the mountain of financial documents scattered across my desk. Another late night, another endless cycle of manual data entry that seemed to mock my ambitions of growing my small consulting business.

“There has to be a better way,” I muttered, rubbing my temples.

The clock read 2:17 AM. Receipts, bank statements, and half-empty coffee cups surrounded me like battlefield debris. Each spreadsheet represented hours of painstaking work, and yet, I knew errors were inevitable. One misplaced decimal could mean financial chaos.

The Weight of Endless Numbers

For years, I’d struggled with the mind-numbing process of financial record-keeping. As a solo entrepreneur, every minute spent wrestling with numbers was a minute stolen from actually developing my business. The traditional accounting methods felt like trying to sail a ship using nothing but a wooden paddle and pure determination.

My previous attempts at streamlining had been frustrating. Spreadsheet templates, manual reconciliation, categorizing each transaction by hand – it was a soul-crushing process that seemed designed to drain every ounce of creativity and passion from my work.

A Glimmer of Hope

Then came the moment that changed everything. During a late-night productivity rabbit hole, I discovered an AI-powered financial management tool that promised to revolutionize how small businesses handle their accounting.

Initially skeptical, I watched demonstration videos with a mix of curiosity and professional cynicism. Could this really be different from every other “revolutionary” software I’d tried?

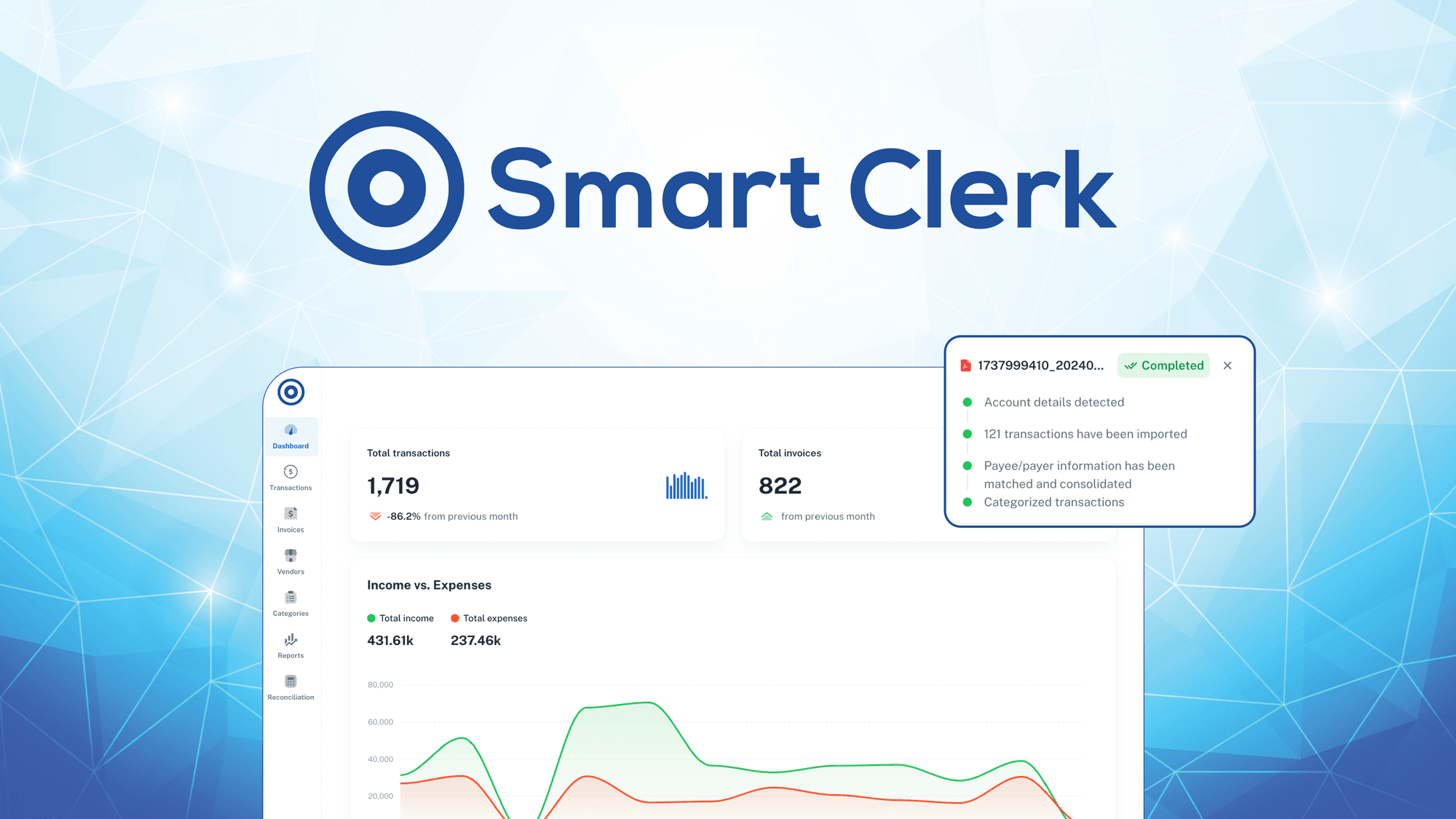

The first time I uploaded my bank statements, something magical happened. Within minutes, complex financial data transformed into clean, organized reports. Categories appeared automatically, transactions were reconciled with incredible precision, and suddenly, my financial chaos began to make sense.

“This is impossible,” I whispered to myself, watching the AI effortlessly sort through months of financial data in seconds.

But it wasn’t impossible. It was a new approach to financial management that understood the real challenge wasn’t just about numbers, but about giving entrepreneurs their time and mental space back.

A New Professional Reality

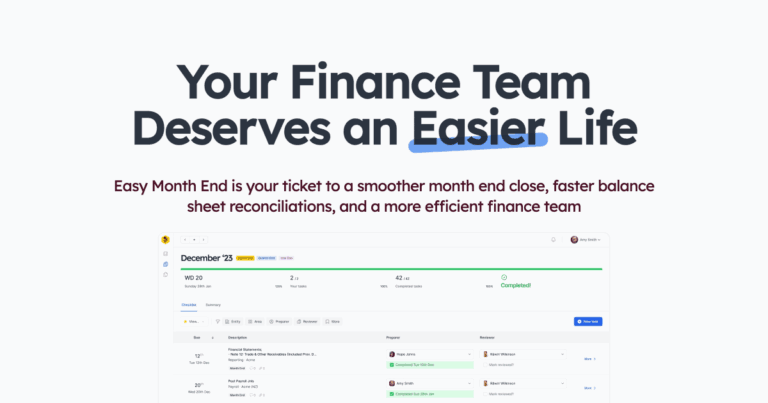

Weeks into using the tool, my entire workflow had been transformed. No more late nights. No more endless manual entry. The AI didn’t just organize my finances; it gave me insights I’d never had before.

I could now see spending patterns, identify potential savings, and generate comprehensive reports with a few clicks. My vendor transactions, previously a jumbled mess, were now crystal clear and easily manageable.

More importantly, I was reclaiming my passion. Instead of being a data entry drone, I was becoming the strategic consultant I’d always dreamed of being.

The Unexpected Liberation

My team noticed the change immediately. “You seem different,” my project manager remarked. “More focused, more strategic.”

And she was right. By eliminating the mundane, I’d rediscovered why I started my business in the first place. The tool wasn’t just about efficiency; it was about liberation.

Epilogue: The Wisdom of Technological Empowerment

What I learned goes beyond accounting. In business, our greatest asset isn’t just our skills or our ideas, but our ability to leverage technology that amplifies our human potential.

For entrepreneurs drowning in administrative tasks, remember this: The right tool doesn’t replace your expertise – it elevates it. It gives you the space to think, to create, to grow. Technology, when thoughtfully applied, doesn’t just solve problems; it transforms how we work, think, and dream.

My financial management journey taught me that innovation isn’t about complexity, but about simplicity. About giving professionals the freedom to focus on what truly matters.

And sometimes, that transformation begins with something as simple as reimagining how we handle our numbers.